You can access this figure by logging in to your online banking portal or heading to the branch and speaking with a teller. Allison Martin is a personal finance enthusiast and a passionate entrepreneur. With over a decade of experience, Allison has made a name for herself as a syndicated financial writer.

Current Balance vs. Available Balance: The Key Differences

Choosing the right checking account for your needs can be a bit of a challenge. If you want further guidance on managing your money, sign up today for Rocket Money℠ and use the app to manage and monitor your accounts today. More specifically, when you deposit a check, the bank may hold some or all of it while it verifies that the check is good and receives funds from the issuing bank. Holding policies can vary by bank, so check with yours to get more information about what you can expect. The funds will typically be available at least as soon as if you had deposited a paper check, and often sooner.

Related articles

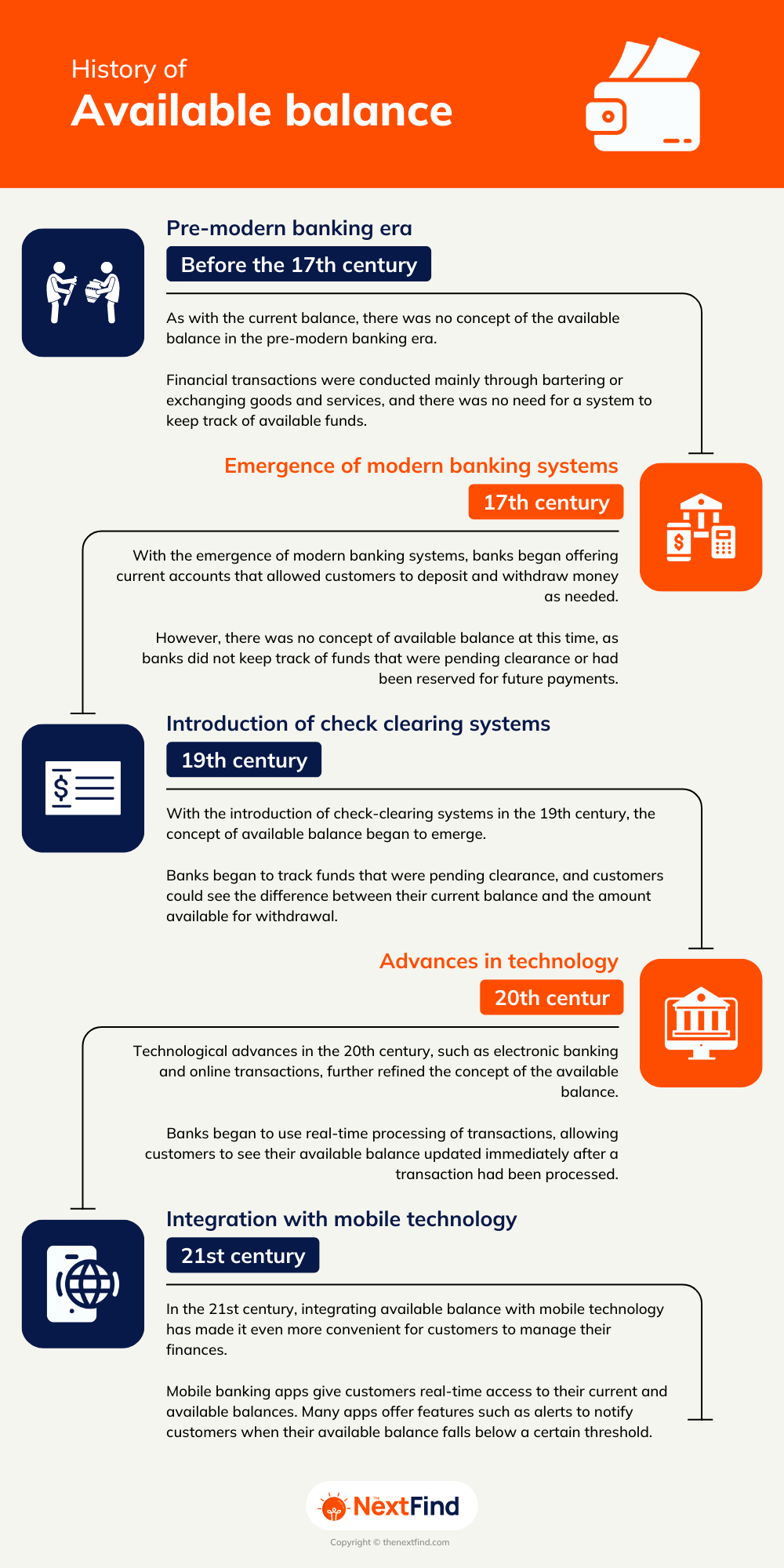

The current balance does not include pending transactions because they have not yet posted to the account. This can be confusing because you may believe you have more money in the account than is actually there if you forget about those pending transactions. The Account Balance represents the total amount of funds in a bank account at a given point in time. It includes all deposits, withdrawals, and any other transactions that have occurred up until that moment. This balance reflects the sum of all the money you have in your account, regardless of whether it is available for immediate use or not.

Available balance vs. current balance

Typically, the first $200 of the deposit is available within one business day, but the remaining balance can take an additional day to appear in your account. A longer delay may occur if you’ve recently opened a new account, have frequent overdrafts, or made a large what is the difference between account balance and available balance deposit. We receive compensation from the products and services mentioned in this story, but the opinions are the author’s own. It’s a place to stash your cash until you demand it, whether you do that by withdrawing money from an ATM or paying a bill online.

Your total balance also does not include checks or other transactions you may have initiated that have not yet been presented to the bank for payment. That means your present balance will probably run higher than your available balance. Basing your spending on this number could cause you to overdraw your bank account. Ideally, you should reference your available balance when making purchasing decisions as it provides the most accurate representation of the funds you actually have on hand.

By understanding the differences between these balances, you can make more informed financial decisions and avoid potential overdraft fees or declined transactions. It is essential to regularly monitor both your Account Balance and Available Balance to ensure you have a clear picture of your financial standing and can effectively manage your funds. For instance, if you use your debit card to make a purchase, the transaction may initially appear as pending until the merchant processes it and the funds are deducted from your account.

Offers that appear on this site are from third-party advertisers from which Credit Karma typically receives compensation. Except for mortgage loan offers, this compensation is one of several factors that may impact how and where offers appear on Credit Karma (including, for example, the order in which they appear). Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline, or hotel chain, and have not been reviewed, approved or otherwise endorsed by these entities. Overdraft protection can help ensure that some transactions go through even if your available balance isn’t large enough to cover them.

Your account balance is the total amount of money that is currently in your account, including any pending transactions (e.g., debit card purchases that have not cleared). The Available Balance, on the other hand, provides a more accurate representation of the funds that are immediately accessible for use. It takes into account any pending transactions, holds, or other factors that may affect your ability to use the funds in your account.

- By understanding the differences between these balances, you can make more informed financial decisions and avoid potential overdraft fees or declined transactions.

- That way, you can keep on top of all the different payments going in and out of your account.

- For instance, if you use your debit card to make a purchase, the transaction may initially appear as pending until the merchant processes it and the funds are deducted from your account.

- Direct deposit payments are sent using the Automated Clearing House, or ACH, network.

- IRA distributions may be taxed and subject to penalties based on IRS guidelines.

Therefore, understanding your Available Balance becomes crucial when relying on overdraft protection. For example, when you check into a hotel, the hotel may place a hold on a certain amount of money on your account to cover potential charges such as room service or damages. This hold reduces your Available Balance but does not immediately affect your Account Balance. The Account Balance will only be adjusted once the hold is released or the transaction is processed. For example, if you have $1,000 in your account and you write a check for $500, your Account Balance will still show $1,000 until the check is cashed or processed by the recipient.

Your bank will typically allow you to make transactions up to this amount. Your available balance and present balance tell you two different things, but both are important to your financial wellness. As pending transactions are processed and cleared, these two balances should sync up. Your available balance is important because it can put boundaries around your spending and prevent overdraft fees.

Last modified: December 18, 2024