I will simply call this the PDVOH rate, to mean “predetermined variable overhead rate.” That is the standard price. Overhead variance regimes typically separate variable overhead from fixed overhead. So they come up with separate variances for variable and fixed overhead. Second, it is more likely that responsibility for overhead costs, even after additional investigation, is spread across several managers and/or departments. That means overhead variances are often less easily actionable than other cost variances.

What is the Accounting for Variances?

In the case of direct materials, it means the standard quantity of direct materials that should have been used to make the good output. If the manufacturer uses more direct materials than the standard quantity of materials for the products actually manufactured, the company will have an unfavorable direct materials usage variance. The variable overhead variance is a measure of the difference between the standard variable overhead costs and the actual variable overhead costs incurred for a given period. Furthermore in a standard costing accounting system, variable overhead has two main variances, the variable overhead rate variance and the variable overhead efficiency variance. Rather than assigning the actual costs of direct materials, direct labor, and manufacturing overhead to a product, some manufacturers assign the expected or standard costs. This means that a manufacturer’s inventories and cost of goods sold will begin with amounts that reflect the standard costs, not the actual costs, of a product.

9 Appendix: Recording Standard Costs and Variances

Assume your company’s standard cost for denim is $3 per yard, but you buy some denim at a bargain price of $2.50 per yard. For each yard of denim purchased, DenimWorks reports a favorable direct materials price variance of $0.50. But the fixed overhead costs applied to product units might be different from what was budgeted simply because the firm has higher or lower volume and due to the the mechanics of absorption costing. Absorption costing tends to lump fixed and variable overhead costs into a rate that is allocated per cost driver unit regardless of the costs’ fixed or variable nature. The variance is calculated using the direct materials price variance formula which takes the difference between the standard material unit price and the actual material unit price, and multiplies this by the quantity of units. The quantity of units will either be the quantity used in production or the quantity purchased, depending on the point at which the variance is to be calculated.

Accounting for Inventory Variances

Allocated fixed overhead cost is more contrived than static budget fixed overhead cost because allocated fixed overhead cost is based on the consumption of the cost driver. And that cost the credit risk and its measurement hedging and monitoring driver (very likely) moves up and down as volume moves up and down. So the allocation of fixed overhead matches a variable cost pattern in that it varies with production volume.

With a little investigative effort, the firm can figure out an action to improve this variance. The standard cost quantity variance is sometimes referred to as the efficiency variance or usage variance. The variance is the difference between the standard units and the actual units used in production, multiplied by the standard price per unit. Often used in manufacturing for accounting for inventories and production. When actual costs differ from the standard costs, variances are reported.

- It is not sufficient to simply conclude that more or less was spent than intended.

- This might seem small, but it dramatically changes how we measure costs and profits (I discuss this a little more in Sections 7.7).

- Or, one can perform the algebraic calculations for the price and quantity variances.

- That means overhead variances are often less easily actionable than other cost variances.

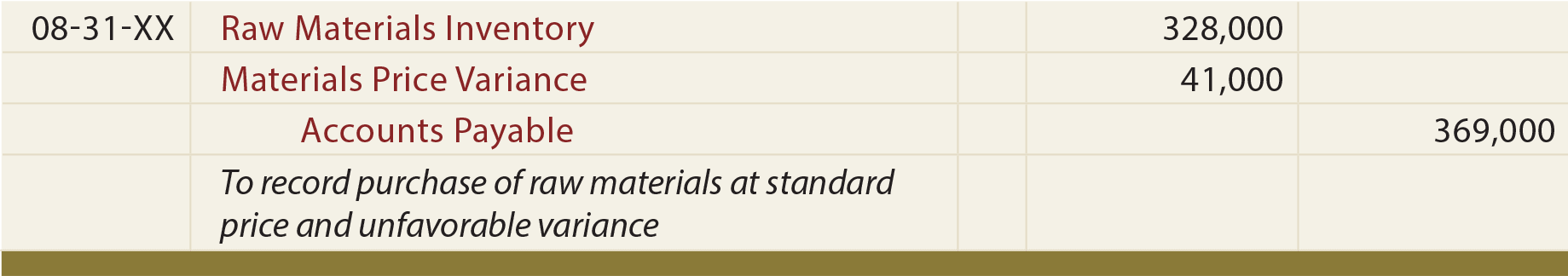

The standard costing price variance is the difference between the standard price and the actual price of a unit, multiplied by the quantity of units used. This chapter has focused on performing variance analysis toevaluate and control operations. Standard costing systems assist inthis process and often involve recording transactions usingstandard cost information. When accountants use a standard costingsystem to record transactions, companies are able to quicklyidentify variances. In addition, inventory and related cost ofgoods sold are valued using standard cost information, whichsimplifies the bookkeeping process. An inventory account (such as F.G. Inventory or Work-in-Process) is debited for $834; this is the standard cost of the direct materials component in the aprons manufactured in January 2023.

So you usually cannot just use the PDOH rate as the standard price of overhead. You have to dig into the budget to find the variable overhead cost rate per unit of the cost driver. When units are moved from the warehouse (or wherever they’re kept) and put into production, your instinct may be to credit the direct materials account for the value of those units and debit the WIP account for the same amount. To solve this the budgeted quantity for quantity variances needs to be drawn from a flexible budget, which is what the budget from last period would have looked like if the firm knew, back then, what actual production was going to be. Product costs, such as direct labor and direct materials are among the most important of these cost variances.

That involves subdividing variances based on their cause, and it’s a prerequisite for actionable information. Managers only invest time and money in variance analysis because it will help them improve future-period profit. That means the comparison between budgeted results and actual results has to be done in a way that suggests at least one action that can be taken to improve profits in the future. So I don’t think it’s fair to call this process a truly “scientific” process. This pattern closely resembles the budgeting, costing, and variance analysis pattern followed by most modern firms of significant size. The firm developed the budget last period, but actual numbers are from this period.

For example, if the expenditure is for indirect materials, the credit goes to accounts payable. If the expenditure is for indirect labor, the credit goes to wages payable. When less is spent than applied, the balance (zz) represents the favorable overall variances. Favorable overhead variances are also known as “overapplied overhead” since more cost is applied to production than was actually incurred. What about the alternative, where the standard cost used to record a transaction is likely incorrect? If so, it is entirely possible that the standard should be adjusted to reflect recent conditions, which means that there should be no variance.

Last modified: December 19, 2024